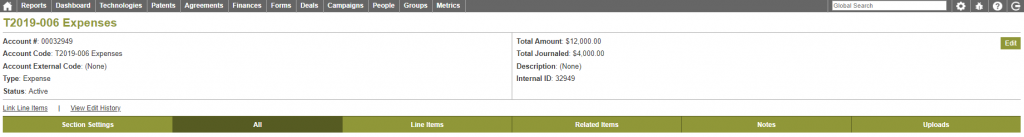

Account Detail Page – Expense

- Account Number – Unique number for the account, internal id

- Account Code – Name of the account that can be edited

- Account External Code – Reference number used by an external organization for this account

- Type – Account type, used for reporting

- Status – Typically active, other accounts will not be displayed

- Total Amount – Sum of line items in the account

- Total Journaled – Sum of the line items in the account that have a journal date that indicates when they were paid

- Description – Additional information about the account

- Internal ID – ID in the database

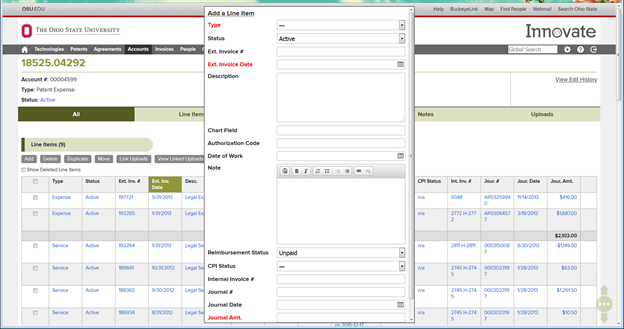

Line Item Fields

- Owning Organization – Organization responsible for paying the expense

- Status – Typically Active

- Type – Subcategory of the expense

- Description – Additional information about the expense item

- External Invoice Number – Invoice reference number for the group sending the expense

- External Invoice Date – Date related to the external invoice number

- Date of Work – The date that the charge was incurred

- Journal Amount – Amount for the work that was done

- Authorization Code – Links to the patent schedule. This is the code that is provided to the law firm approving the work to be done.

- Note – Internal notes about the line item

- CPI Status – Used for annuity expenses

- N/A – Item is not a annuity related

- Approved – Item is approved to be paid

- Rejected – Item has been rejected and a credit should be issued

- Expense Stage – The location of the expense in the payment process

- Stage 1: Legal Expense Incurred – The invoice from the law firm has been manually entered in Innovate and needs to be reviewed internally. Invoices uploaded by the law firm will not appear in the patent expense account. If a manually entered invoice is denied, the line item should be deleted.

- Stage 2: Legal Expenses Incurred & Approved – The invoice has been approved by the internal approver and is ready for the finance team to pay

- Stage 3: Legal Expenses Incurred, Approved & Paid – The invoice has been approved by the internal approver and has been paid by the finance team. At this point the line item should have a payment request number and date and/or a journal number and date

- Chart of Accounts – Chart of accounts from the general ledger to which the expense posted

- Payment Request Number – Reference number for the payment request from the ERP system

- Payment Request Date – Date associated with the payment request number

- Journal Number – Reference number for the posted transaction in the general ledger

- Journal Date – Posted date of the payment that is related to the journal number

- Reimbursable? – Any line item that is not yes, will not appear on an invoice for reimbursement

- Yes, can be invoiced – Expense can be passed on to a licensee or co-owner

- No, should NOT be invoiced – Expense cannot be passed on to a licensee or co-owner

- Do not invoice; already paid – Expense cannot be invoiced as it has already been paid

- Do not invoice; already paid by another party – MAY BE DELETED

- Do not invoice, past agreement expiration or termination date – MAY BE DELETED, REPLACED WITH AGREEMENT REIMBURSEMENT SCHEDULE

- Do not invoice, on payment plan – Expense cannot be invoiced because it is related to a payment plan

- Do not invoice; outside acceptable date range – MAY BE DELETED, REPLACED WITH AGREEMENT REIMBURSEMENT SCHEDULE

- Do not invoice; historic – Expense cannot be invoiced because it is too old and may have already been reimbursed

- Hold – Expense cannot be invoiced until further review

- Do not invoice; mistake – Expense cannot be invoiced because it was paid or entered in error

- Cost Sharing – Expense can be invoiced to a co-owner, Do not use

- Invoices – Innovate invoice number or invoice number converted from a previous system

- Historic Invoice – Manually entered invoice number

- Reimbursement Status – Will be removed when invoice enhancements are released

- Paid

- Paid (Manual Override)

- Partial Payment

- Partial Payment (Manual Override)

- Unpaid

- Unpaid (Manual Override)

- Uploads – Any uploads related to the line item will be identified as present with a paper clip in the field

- Reference Number – Line item reference number generated in Innovate or converted from a previous system. Clicking on the link opens the line item detail page.

- Reference Date – Date associated with the reference number that was converted from a previous system

- External Reference Number – Field may or may not be populated with data from a previous system, depends on data

Expense Accounts – Legal

Each law firm and/or annuity service provider should have a unique account for each patent record so that reports can effectively provide what was billed and paid to each firm.

Ledes Imported Legal Invoice

LEDES Line Item Types will be created in the system as a type of service or expense

Services – Charges for attorney time to complete work

Expenses – Reimbursable expenses billed by the law firm for costs associated with services (mailing, phone calls, etc.)

Manually Add a Legal Invoice

It is necessary to include the following information from the legal bill for the patent expense line item to be included in reports:

- Code – Law Firm matter number, number that is used by the firm and the office to reference a legal bill account. The matter number can be located by using the global search feature in the top right corner of any page or can be located by navigating to the associated technology or patent. If the matter does not exist, create a new matter through the associated technology or patent record.

- Line Item Type – Service, Expense, or Legal Fee Cost if a combination of both

- Line Item Amount – Amount of the invoice or line items billed. LEDES file upload allows for more detailed information about the fees being charged

- Line Item Invoice Number – Invoice number from the law firm or third party

- Line Item Journal Number – The reference number from the general ledger for the payment to the law firm

- Line Item Journal Date – The date from the GL that corresponds with the journal number for the payment to the law firm

- Line Item Chart of Accounts – Reference to the debit or credit to the account in the general ledger

- Law Firm – Law firm billing for the work. When a new matter is created, the record must be related to the law firm doing the work by selecting “law firm ours”. The reports will include these line items when summarizing patent expenses paid and can be searched on by firm.

Each law firm and/or annuity service provider should have a unique account for each patent record.