Invoices – Financial Compliance (Revenue)

Innovate does not allow an invoice to be sent to a licensee for more than one agreement and does not allow an invoice to combine reimbursements and revenue.

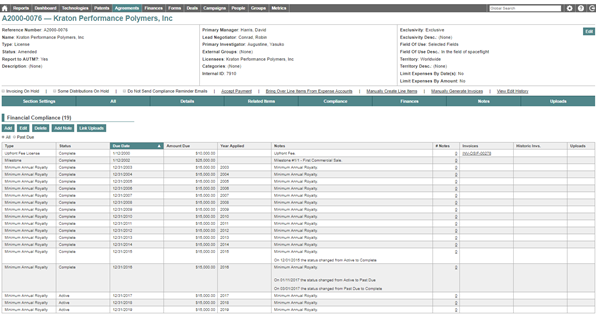

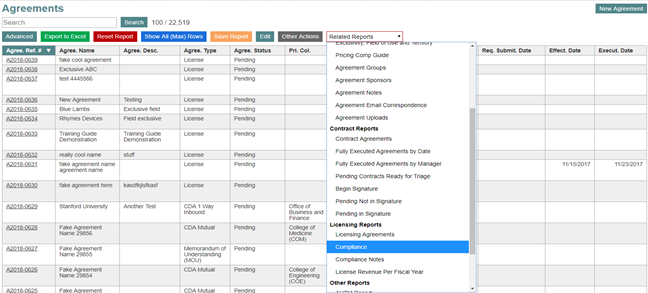

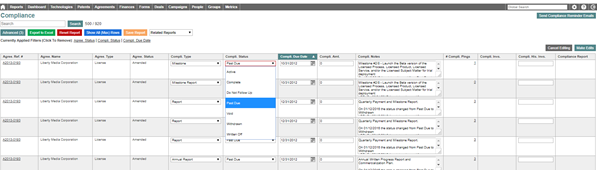

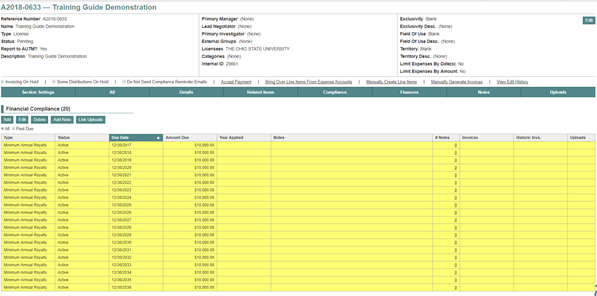

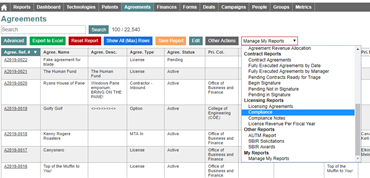

For invoicing to function appropriately the terms need to be entered in the agreement compliance section of the agreement. To complete invoicing for financial compliance terms, navigate to the finance section and click on “Financial Compliance Invoicing” under the Revenue category. The unfiltered report can be accessed by clicking on Agreements in the navigation bar and selecting compliance under Licensing Reports from the drop-down. This report includes all items that have been entered into the compliance section in the agreement that are active and past due. Active means that the item is within 30 days prior to being due and past due is anything that is beyond the due date. To view only items that are financially related, omit reporting from the compliance type.

Modify the line item by entering the agreement page and making the appropriate adjustments in the compliance section or by clicking on “Edit” in the search section. There are seven options from the compliance status:

- Active – Is within 30 days of being due

- Complete – Has been paid

- Do Not Follow Up – Do not ping the licensee (recommend including a note)

- Past Due – Is past the due date

- Void – Should not have been invoiced (recommend including a note)

- Withdrawn – Do not bill (recommend including a note)

- Written Off – Invoice was sent and written off (recommend including a note)

A best practice is to match the line items on the compliance report to payments that have been posted in either the revenue or patent reimbursement account or that have been invoiced and are awaiting payment. It is recommended to enter the invoice number if it is available prior to marking an item as complete. It is also recommended to enter an invoice number for any item that has been billed where the invoice number field is blank.

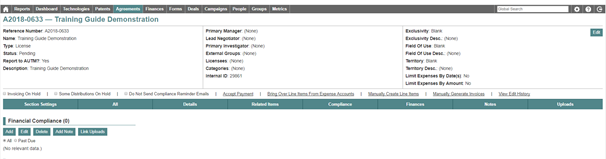

Create Financial Compliance Items

Invoicing

There are reports to identify when financial compliance items are ready to be invoiced. Be sure that the filters are appropriate so that nothing is missed when invoicing.

- Finance Menu – Financial Compliance Invoicing

- Agreements Search Page – Compliance in dropdown

From the agreement record, click on generate invoices under the header to open the generate invoices page. Un-checking the boxes next to the items will remove them from appearing on the draft invoice. Review the items that will appear on a draft invoice. Once the review is complete, click on generate in the top right corner of the generate invoices page to create the draft invoice. The draft invoice number will then appear in the invoice field. A draft invoice number is identified as a random string of text instead of the sequential numbering of a finalized invoice.