Agreement Record – Compliance

Data entered in the financial compliance and reporting sections can be viewed in a comprehensive report in the agreement search page drop-down licensing reports, compliance.

- Financial Compliance Amount owed, type of liability, due date, and description. The financial compliance section is the beginning of the invoicing process for revenue items and (occasionally) reimbursement payments owed.

- Payment Plans and Schedule Items – In development, will be used to capture money owed for the reimbursement of past expenses

- Reporting Compliance Report type, due date, and description

- Sponsors Related sponsoring group(s)

- Terms Terms of the agreement (royalty rates, sub-license fees, etc.). Data is used for the pricing comp guide using the description field to compare terms relative to other agreements.

Financial Compliance

- Add

- Type – Type of charge. Some examples are milestones, upfront fees, minimum annual royalties, sales royalties, etc.

- Status

- Active – Will be something to invoice in the future or is within 30 days of the due date

- Complete – Has been invoiced and paid

- Do Not Follow Up – No action required

- Past Due – 1+ day(s) after the due date

- Void – Should not have been invoiced and the corresponding invoice has been voided

- Withdrawn – No action required

- Written Off – Has been invoiced and the invoice has been written off

- Due Date – Date from the agreement that the item is due. The compliance report filters show items that are due 30 days or more before this date that are active or past due.

- Amount Due – Amount due per the agreement

- Royalty Rate – Royalties due per the agreement

- Year Applied – No current use

- Description – Description of the compliance item that also appears on the invoice when generated

- Historic Invoices – Manually added invoice number for invoices not generated or linked in Innovate

- # of Items – Number of times this item should recur

- Frequency – When the item should be billed (annually, quarterly, etc.)

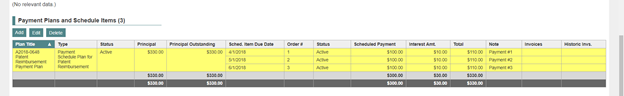

Payment Plans

#1 Payment Plans – Financial Compliance

- In the agreement compliance section, create new line items and use the type reimbursement or the appropriate revenue type. These will then show to bill on the compliance report.

- Enter the schedule from the agreement. This should be uploaded to the uploads section of the agreement record. Occasionally there are rounding errors between the figures in the agreement and the table in Innovate. Ultimately, the individual payments are what should match.

- If this method is chosen for the invoicing of reimbursements, update the header in the invoice section prior to finalizing the invoice. Failure to do so will result in an incorrect aged receivables report, incorrect invoice numbering in institutions where the numbering is conditional, and the potential for the payments to be entered in the wrong account.

- When completing a payment plan for reimbursement, there should be a backup document uploaded to the agreement record that was obtained from the finance team prior to execution of the agreement. Once the payment plan is entered, update the expense line items and edit the line item “Reimbursable?” field to “Do not invoice, on payment plan” so that they are not invoiced when monthly reimbursement invoicing occurs, which would result in overcharging the licensee.

#2 Payment Plans and Schedule Items – IN DEVELOPMENT, only use if also charging interest

If the amount of the payment plan equals the expense line items, update the “Reimbursable?” status on those line items to “Do not invoice, on payment plan”. Failure to complete this step will result in over-charging the licensee when monthly reimbursement invoicing occurs. If it is determined that the office will not receive any more invoices for the payment plan period referenced in the agreement, the reimbursement schedule can be used to define a start date so ongoing billing does not include these invoices. Prior to creating a payment plan, click on the accounts section in the ribbon and add a reimbursement or revenue account to which the payment plan will be connected.

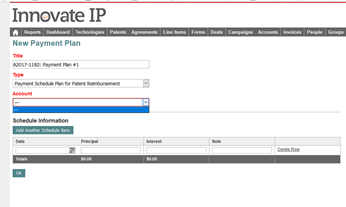

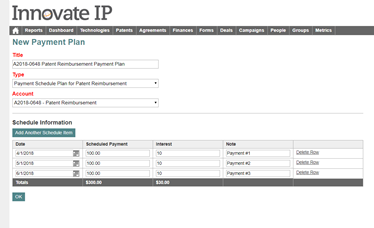

Create a Payment Plan

- Add

- Title – Should be clear and concise, with the agreement record included. If it is related with another agreement due to an amendment, it is recommended to add that it is replacing a payment plan on the parent agreement and reference that number

- Type

- Payment Schedule Plan for Reimbursement – Legal Expenses

- Payment Schedule Plan for Revenue – Revenue

- Account – Select the account where the funds should be deposited when payment are received

- Schedule Information – Enter the schedule from the Agreement. This should be uploaded to the uploads section of the Agreement record. Occasionally there are rounding errors between the figures in the Agreement and the table in Innovate. Ultimately, the individual payments are what should match.

Once the payment plan is complete, it is visible in the compliance section of the agreement. When completing a payment plan for reimbursement, it is advised to include a backup document uploaded to the agreement record that was obtained from the finance team prior to agreement execution.

IT IS CURRENTLY NOT POSSIBLE TO EDIT THE PAYMENT PLAN AFTER IT IS FINALIZED ON THIS SCREEN SO REVIEW FOR ACCURACY OR ELSE IT WILL NEED TO BE DELETED AND RE-ENTERED

Reporting Compliance

- Type – Which report is required. This includes funding and employment surveys, quarterly reports, annual reports, etc.

- Status

- Active – Report is due in the future or is within 30 days of the due date

- Complete – Report has been received

- Do Not Follow Up – Is not complete, but efforts to obtain the report have been abandoned

- Hold – Is not complete, temporarily suspending efforts to obtain the report

- Past Due – 1+ day(s) after the due date

- Void – Not relevant in this context

- Withdrawn – Not relevant in this context

- Written Off – Not relevant in this context

- Due Date – Date the report is due per the agreement. The compliance report filters show items that are due 30 days or more before this date with an active or past due status

- Notes – Description of the report

- # of Items – Number of times this item should recur

- Frequency – When the item should be reported (annually, quarterly, etc.)